- Introduction

With every article of the Microbiome Times, one sees the therapeutic microbiome industry edging ever-closer to full commercialisation of their products. Understandably, much of the focus has been on the challenging process of demonstrating clinical efficacy that is required to obtain marketing approval from the various National and Regional Medicines Authorities. In January 2020, the FDA clinical trials database already listed 75 active clinical studies that evaluate some part of the microbiome and use some kind of a probiotic as a drug substance. Six of these studies have reached Phase 3. The targeted diseases are not only focused on gut disorders, but also vary from neonatal asphyxia and polycystic ovary syndrome, to type 2 diabetes and depression. Clinical approval is of course not the only hurdle to jump on the track to full commercialisation. The industry will also have to demonstrate that they can meet significant logistical challenges, namely, how to manufacture the probiotics in industrial scale and with consistent levels of quality.

We focus here on the challenges, and resulting commercial opportunities, in large scale production of therapeutic microbes, and provide our thoughts on how a strategic view on protecting intellectual property with patents and know-how around the manufacturing processes can help reap commercial advantages in the therapeutic microbiome market.

- The Challenge

It is well known that microbes are in general sensitive to growth conditions. Control of these conditions is vital to commercial success of the therapeutic microbiome industry as it will be required to demonstrate very high levels of consistency in output whilst using economically efficient processes. It has been suggested that most of the probiotic strains currently tested are selected based on our technological skills to grow them in large scale and not on ecological criteria[1]. This is likely due to the challenges to grow the “ecologically” most relevant microbes in large scale. In other words, the microbes that might be the most relevant as future therapeutics might be the hardest to grow, and the industry has not yet embarked on the path of making many of them on the scale that will be required.

Relatively less work in the industry has been carried out developing scale-up production of microbial therapeutics than on isolating and characterising new therapeutics in this field. This is also reflected in the academic field. Martha Clokie (Professor of Microbiology at the University of Leicester) has reported that less focus and research funding is placed on production when compared to studies directed at isolating new therapeutic species; phage species being Professor Clokie’s particular focus). Professor Clokie has commented that she recognises the importance of such scale-up in order to facilitate real translational work, but also that such work is not easy.

“Because microbes are sensitive creatures, it is hard to produce them in large scale without affecting their viability”.

Martha Clokie, Professor of Microbiology, University of Leicester

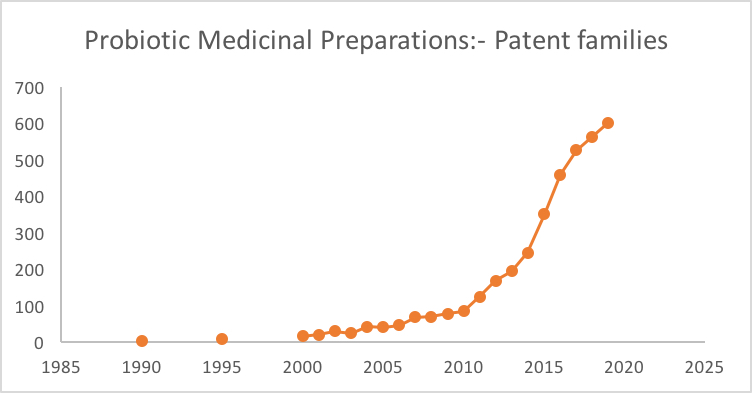

When one looks at the numbers of patent applications filed in the medicinal probiotic space, we can clearly see that significant inventive activity in the microbiome space is growing significantly year by year (see graph). However, we have thus far seen relatively few patent claims being filed to any specific processes or steps that would address the need to develop technologies for growing therapeutic microbes in large scale.

- Addressing the Challenge

Recently, we have seen the formation of new companies and collaborations to directly address the challenge laid out above for large-scale production of therapeutic microbes. On that basis, we should expect to see rapid developments in this area.

This year started with Biomica announcing that it has entered into a service agreement with Biose Industrie for scale-up of their two microbial consortia therapeutic candidates. According to Richard Ellis, the Head of Business Development at Biose industrie:

“Biose Industrie have been making microbes as medicines both at drug substance and drug product level for over 60 years but the new wave of commensal anaerobic bacteria has proved an interesting challenge. We have been, however, manufacturing strict anaerobes at industrial levels for clinical trials since 2018, and we are currently investing in excess of 30M€ in a one stop shop plant in France.”

Biose Industrie is currently manufacturing in 3500L reactors a number of different strict anaerobes.

Through 2019, we saw two companies forming to address this challenge directly.

Arranta Bio was formed in May 2019 and announced in October of the same year that it had completed an $82 million funding round. A press release from Arranta Bio declarers that:

“Our aim is to support the pioneers in the development of healthcare therapies based on live biotherapeutic products (LBPs) targeting gut health and microbiome-related diseases by providing development and manufacturing services that bring effective treatments to the market and patients in need.”

In a January 30th2020 press release, Arranta Bio announced that

“it commits to a $100M investment in building end-to-end microbiome capacity”.

The end of August 2019 saw the formation of Bacthera, a 50-50 joint venture between Chr. Hansen Holding A/S and Lonza AG. The stated aim of this company is to operate “in the emerging market for live biotherapeutic products”. The two founding entities announced that €90 million will be invested over a period of three years.

“Over the coming months Bacthera will upgrade existing facilities in Hørsholm, Denmark, and equip new facilities in Basel, Switzerland to serve pre-clinical to phase II projects. Further facilities for phase III and commercial manufacturing will be developed as the pipeline matures”.

With funding on this scale, clearly some have identified that addressing the challenge of large-scale production of live microbes is of substantial commercial interest.

- Commercial Opportunity

The most obvious commercial opportunity comes from the fact that a consistent and economically efficient process for making large amounts of a therapeutic can substantially increases the value of the therapeutic. Without consistency and scale of production, the potential market for the therapeutic cannot be fully realised. Additionally, the cheaper the production can be, whilst retaining a consistent efficacious product, the greater the margin of profit can be returned to the innovator. This is clearly a driver for the microbiome therapeutic innovator, but also can help drive collaborations that are vital for those in the process-innovation sector.

The most substantial commercial opportunities will likely be found in process-innovations (whether it be the chemistry, biology or machinery) that are not restricted to optimisations in a production process suitable for only a single bacterial strain. The microbiome therapeutics in development tend towards consortia, so such restricted process-innovations would not facilitate even a single therapeutic composition based on a combination of bacterial strains/species. Perhaps the ultimate commercial goal in this field would be to identify a process that is generally applicable to all bacterial or phage species and in all instances provide a profound benefit. If that benefit relates to economic efficiency, this would be the go-to process for all in order to drive profit margins (assuming a reasonable license fee could be agreed for many). It may be even more interesting if that benefit related to the consistency of level of efficacy or ability to remove clinically unhelpful aspects of the end product. If such a process was generally seen by the national medicines authorities as the safest and most reliable way of producing microbiome therapeutics, adopting this “gold standard” method of production could assist in establishing a smoother and faster route for approval to market. The party with power to license such a gold-standard would clearly hold a very valuable asset. This commercial advantage can however only be exploited if that party has some form of monopoly for the process.

Based on our discussions with the members of the industry, they see that right now there are clearly some defining characteristics around certain species when one takes into account the media, freeze drying and concentration. We have heard that people are seeing regularly contrasts at strain level at some point during the processes, and that in general there is a lot of diversity in what makes any one strain grow. Thus, this is where the industry sees is a lot of value to be brought by a CDMO.

- What part can IP play?

Knowing that manufacturing methods may prove to be a key driver for profits in the probiotic therapeutics industry, what would be the best strategy to protect the intellectual property in live microbe manufacturing; how can you use IP to establish a commercially relevant monopoly?

When the innovation relates to a new composition of bacteria for use as a therapeutic, it is generally correct to assume that pursuing patent protection for that composition is the best route. Once such a product is brought to the market, any competitor can simply purchase some product and by virtue of the biological nature of the product, copy the product by growth of the population in the sample purchased. Whilst the regulatory approval system may be used to prevent this third party from marketing the “copy” for a time, patent protection is likely to be the most effective and long-term strategy for preventing others from copying your innovation and marketing this copy in direct competition.

Strategies for protecting process innovations are generally more complex.

Firstly, an innovative process for scaling-up of a therapeutic microbiome product is normally a complex array of novel steps (including the order of known steps), conditions and reagents. Filing a patent application to protect each aspect of novelty is generally too costly a strategy on which to embark. Secondly, keeping the innovative elements of a process a secret is not as difficult as keeping the nature of a composition a secret. It is much more difficult, and often impossible, to derive the process of manufacture from the marketed product itself. Consequently, keeping elements of a process a secret and recognising their value by identifying these elements as company “know-how” is an important part of an appropriate IP strategy for a process innovator. Whilst the protection of know-how is relatively cheap (essentially requiring the time and effort of a good internal system of logging, and internal training so that staff realise how to use know-how, that it must be kept confidential, and establishing some internal restrictions on access to the details of the process), it is not without its limitations. Checks can be put in place to help keep know-how confidential within a business. However, businesses can be “leaky”, and staff can move and often do not fully appreciate their obligations to past employers. Once know-how becomes public, it no longer exists as a piece of proprietary IP from which you can gain competitive edge, or indeed to add value to the business. Also, unlike patent protection, if a third party were to develop the same innovative process independently, that third party could not be prevented from using that process and competing directly with the original innovator. This is of considerable concern for any aspect of a production-process that provides considerably benefit. If it is apparent that a party has arrived at such an aspect, third parties are strongly motivated to direct considerable energy on cracking the secret behind the innovation. Without a patent, such a third party could not be challenged to prevent from exploiting the innovation once the secret is cracked.

Creating an optimal strategy, therefore, likely involves a carefully planned combination of patent filings and know-how to protect the innovation.

As mentioned above, we are only seeing the beginning of a growth period of innovation in the production-process field for therapeutic microbiome products, and so have little direct experience to draw on in relation to optimised IP strategies. However, we can gain insight from examples of scaling up of microbe production in the food and beverage industry, where microbes have been used in industrial scale production for over a century.

The food industry is one that requires a lot less investment to bring a product to market than any therapeutic, and that generally enjoys a much lower level of profit margin from the sale of their products. Even though profit margin is lower, it is clear that the food industry has relied on the patent process as a powerful tool, when used judicially alongside know-how, to protect profits from their innovations.

A review of patenting activity on the process of growing the modern baker’s yeast by Pierre Gelinas (2014) provides an interesting long-term perspective on what appeared to be important for the industry to protect with patents, and what were some of the critical, litigated areas. According to the review, during the “golden age” of modern baker’s yeast manufacturing, from 1910 to 1940, much effort was put into finding the best and cheapest growth media available. However, this did not result in much litigation. In contrast, techniques for increasing biomass yields and reduction of costs by the control of both infection and sugar concentration in sugar-rich growth media was clearly considered “patent-worthy”. The review found the most important patenting activity around the control of sugar concentration in growth media, with total of 90 patents, including 38 patents on inventions related to “continuous culture.” Interest of the inventors was reportedly similar for seed production and infection control during fed-batch fermentation, respectively, with 38 and 36 patents. The review noted that some interest was given to nitrogen concentration (26 patents), final conditioning steps (23 patents), and temperature control (12 patents). Interestingly, the fermentation control patents were the ones that were litigated the most -and we would therefore suggest were the most commercially relevant. While the article concludes that the invalidation of some of the key patents may have contributed to the reduction in patenting activity in later years, it is worth noting that the industry fought several court battles between the key players to fight for the market positions. Moreover, the maturing of the growth technology also likely played a role in the levelling of the patent filings. The industry clearly therefore identified key aspects of the process of manufacture where innovation provided sufficient benefit to justify the expense of patent filings, and the cost of litigation to protect the monopoly they built up from those filings. Selecting those key aspects around which the most substantial benefit pivots would appear to be an important step in the process of building an appropriate IP strategy.

The food industry makes it clear that patent protection is not merely of historic interest. Jennewein Biotechnologie GmbH, one of the leaders in the manufacture of human milk oligosaccharides (HMOs) has built up a considerable patent portfolio to protect their innovations relating to the production of HMOs by microbial fermentation, and subsequent extraction of HMO from the resultant broth. This portfolio has been demonstrated to be an important tool for retaining the company’s technical dominance in the field. The value of such a portfolio can be shown by the fact that one of their early patent filings, relating to a “Process for efficient purification of neutral human milk oligosaccharides (HMOs) from microbial fermentation” is currently being opposed by, among others, BASF SE, one of the largest chemical producers in the world.BASF SE clearly want a part of the lucrative HMO market and this patent is an obstacle to them simply copying Jennewein Biotechnologie GmbH’s technology and entering the market. The cheese industry provides numerous further useful examples. For example, in 2018, CSK Food Enrichment BV successfully defended their patent for a method of producing cheese using a nicin-producing direct vat set culture against attack from Chr. Hansen A/S (only one example of numerous IP related tussles between CSK and Chr. Hansen).

If the food industry, with relatively low profit margins, has identified that a combination of patent protection and know how is required to efficiently exploit their technical developments, the microbiome therapeutic industry, with much higher potential profit margins, is likely to find such a strategy even more important.

- Developing an Appropriate IP strategy

How does one start to develop an appropriate strategy? A rigorous and logical analysis of your process must be at the core of the answer to this question, and further, that this analysis should involve input from both technical and commercial aspects of your business.

We would advise that the first action should be for the technical team to map out a step by step flow-diagram of your innovative process (with every aspect of the flow; including operating conditions, reagents, steps and their order, products and intermediate products). Following this, the protection of identified products by patent should be considered a priority, for the reasons stated above. Attention should then be directed to the process. We would advise that the technical team then look at each aspect of the flow and ask a first question: “Is that aspect new?” If it is not, disregard from further analysis and move onto the next aspect. Once you have identified all aspects of the flow that are new, you must start to divide them into two “buckets”: (1) aspects for patenting and (2) aspects for know-how. This is where the analysis needs input from the commercial team and from patent attorneys with experience in this field of technology. Each novel aspect should be analysed for their commercial relevance. The technical team should explain to the commercial team what is the technical benefit derived from this novel aspect of the process, and what is the scale of benefit. The commercial team should then determine if that benefit, at the stated scale, is of significant value to the business. A net increase in yield of 0.5% may be considered of minimal significance (e.g. not a concern if competitors adopt that benefit), whilst a 25% increase may provide a substantial benefit to profit margin or provide a competitive edge over competitors (particularly if the basic product cannot be patented itself). A patent attorney should then be able to provide advice on how likely, based on the facts to hand, a patent will be granted for a process defined by the commercially relevant aspect. Aspects determined to be both patentable and of commercial relevance are placed in bucket (1). Therefore, if the aspect, for example, solves a process bottle-neck to make the production or purification significantly less energy consuming, less raw material consuming, or significantly increases the yield, it is likely a significant asset and worth protecting by a patent. While fine-tuning the processes with marginal gains may be best left for know-how. Consequently, all other aspects not selected for bucket (1) are to be placed in bucket (2). For early stage start-ups, where cash-flow is a serious issue, we would advise a further analysis step. If numerous aspects are placed in bucket (1) and these require a patent filing per aspect in order to secure maximum protection, the most commercially relevant aspects are retained in bucket (1), whilst the others are moved to bucket (2) with review date for considering if funding will permit the aspect to be moved back into bucket (1). At that date the original commercial assessment should be reviewed to ensure that it remains valid.

As with many aspects of business, a good strategy adopted early will most likely optimise your ability to receive reward for the innovations you bring to the industry.

_ _