Over the past several years as microbiome drug development programs continued to advance worldwide, the entire industry looked to the most clinically advanced companies to see whether their Phase 2 and 3 clinical trials would satisfactorily demonstrate safety and efficacy. In 2020, those in the industry can finally point to some impressive clinical results that can serve as an endorsement for this entirely new class of medicines. Those in the industry can benefit from taking a closer look at how these leading companies have improved their science and adjusted their focus to maximize success.

This year was also dominated by the COVID-19 pandemic – and biotechnology companies, like all other companies, had to adapt their practices in accordance with local public health measures. Not only is the pandemic affecting company employees on a personal level, but it is also affecting microbiome-focused companies’ clinical programs: for example, adjustments may be necessary for clinical trial recruitment or clinic visit scheduling. Despite these challenges, however, several important advancements have set the industry on a promising course. Some companies are even poised to take advantage of the opportunities that have arisen from the general public’s increased focus on health and infection prevention in 2020.

Clinical trial results validate technologies and generate momentum

Clinical trial results from several major microbiome biotechnology industry players with late-stage programs were eagerly awaited by those in the industry this year (see a summary here) to affirm the value of microbiome-based technologies. Now that these encouraging results have been released, they may serve to boost the confidence of microbiome drug developers.

Arguably the major milestone for the entire industry in 2020 was Seres Therapeutics’ (Nasdaq: MCRB) announcement of the positive results from its SER-109 Phase 3 ECOSPORIII clinical study (NCT03183128) for recurrent Clostridioides difficile infection (CDI) in August (see article here). The study showed that SER-109 administration, compared to placebo, resulted in a highly statistically significant decrease in the proportion of patients who continued to experienced recurrent CDI after eight weeks, which was the study’s primary endpoint (see press release here). These results exceeded the statistical threshold previously provided by the US Food and Drug Administration (FDA) that could allow a clinical study to fulfill the requirements for drug approval under Biologics License Application (BLA). Also, the study showed that SER-109 had a good safety profile, one that is comparable to placebo, which is good news after the FDA’s repeated safety alerts over the past 18 months regarding the current alternative to this drug therapy – fecal microbiota transplantation (see article here).

Despite the strong clinical program to support drug approval, some safety questions remain. Moreover, the product continues to face regulatory uncertainty since the FDA has never granted market authorization to any similar product before. So far, correspondence between the company and the FDA has been around Seres’ request for a Breakthrough Therapy Designation meeting with the Agency (see press release here). The FDA responded in the negative to this petition, reiterating its previous position that at least 300 patients are required in order to assess safety with confidence. Seres is currently running an open-label study (ECOSPOR IV, NCT03183141) to expand its safety database and fulfil this requirement, since their Phase 3 study included data for only 105 patients (see article here).

Seres´ results have not been the only positive Phase 3 trial outcomes released this year. In May, Rebiotix-Ferring Pharmaceuticals released preliminary results from their PUNCHCD3 trial (NCT03244644) with their investigational drug RBX2660 for recurrent CDI (see press release here). The company plans to release final results of this study by the end of 2020.

Furthermore, yet another competitor, Finch Therapeutics, recently announced positive results for treating recurrent CDI with a similar product, the orally administered Full-Spectrum Microbiota™ CP101, this time in a Phase 2 trial (PRISM3, NCT03110133). This product prevented CDI recurrence in 75% of patients, compared with 62% who received a placebo, a statistically significant result (see press release here). Finch is also planning to meet with the FDA to discuss a path to a possible BLA (see article here).

Previously, many had remained skeptical about the efficacy of microbiome-based drugs in general after the unsatisfactory results in Phase 2 trials with SER-109 in 2016 (see press release here) and RBX2660 in 2018 (see publication here). But these positive 2020 results for the leading indication, recurrent CDI, have served as a vote of confidence for the entire microbiome pharmaceutical industry.

Clinical turnarounds by Seres and Rebiotix are particularly important for the entire sector because they may provide key learnings for future clinical programs in microbiome drug development and signal the maturation of the industry. For instance, for its Phase 3 trial, Seres increased the bacterial dose in SER-109 ten-fold compared to Phase 2, while keeping it within the range tested in a previous Phase 1 trial. Also, Phase 2 patients had been enrolled based on a PCR test to detect C. difficile, which did not distinguish between actual infection and natural, innocuous colonization; this led the investigators to suspect they had overestimated the incidence of CDI in the patient population. For Phase 3, the investigators employed a cytotoxin assay, which reveals pathogenic activity of C. difficile. This proved to be a better strategy, leading to a more targeted patient population and increased clinical success (see article here).

A limitation of these results is that, despite having a clinical indication (recurrent CDI) in common, they are not directly comparable as they involved different patient populations and employed slightly different therapeutic approaches to mimic FMT. This diversity of approaches, however, provides early evidence that different strategies can be successfully employed to achieve clinical benefits via the microbiome; although Seres, Rebiotix and Finch are all employing stool-derived materials as drugs, Seres’ product comprises a more refined consortium (dozens of bacterial strains) rather than full-spectrum fecal microbiota. There are also notable differences in route of administration: Rebiotix’s candidate is delivered via enema, while Finch’s and Seres’ are orally administered. These amount to scientific endorsements for several different technology platforms and therapeutic approaches that are used across the entire industry.

Besides these late-clinical-stage, high-impact results, some promising Phase 1 results were released by a number of microbiome drug developers mid-year. In June, Vedanta Biosciences announced positive results from two trials with their orally-administered candidate VE202 for inflammatory bowel disease (IBD) (see press release here). These data will lead into a Phase 2 study, for which results are expected in the first half of 2021 (see article here). Positive results from this trial would generate a second wave of confidence in the industry next year, since VE202 is a defined consortium of only 11-16 specific strains—very different from consortia that approximate fecal microbiota transplantation—and targets IBD, an application very distinct from CDI. Only by succeeding in different applications with different approaches and diverse mechanisms of action can the sector fully create a rationale for developing drugs with or through the microbiome, as some believe that succeeding in recurrent CDI was inevitable because the efficacy of fecal microbiota transplantation for this indication was already established before Seres’, Rebiotix’s and Finch’s results.

In July, Evelo Biosciences (Nasdaq: EVLO) presented interim results from their Phase 1/2 study of EDP1503 (single strain Bifidobacterium animalis ssp. lactis), in combination with Merck & Co.’s (NYSE: MRK) Keytruda® (pembrolizumab), on anti-tumor responses in patients with advanced colorectal carcinoma, breast cancer, and checkpoint inhibitor relapsed tumors (NCT03775850). Based on preliminary safety and efficacy data, the sponsor decided to continue to recruit for this trial and expects to report more results before the end of 2020 (see press release here).

In August, Precigen ActoBio (Nasdaq: PGEN) went public with positive results of a Phase 1b trial with their oral treatment AG019 ActoBiotics™, a GMO Lactococcus lactis designed to deliver human proinsulin and interleukin-10 to the intestine, in early-onset Type 1 Diabetes, in combination with the monoclonal antibody teplizumab (PRV-031, NCT03751007, EudraCT 2017-002871-24). A Phase 2a study is currently ongoing (see press release here).

Also in August, 4D Pharma plc (AIM: DDDD) reported results of the first part of their Phase 1/2 trial (NCT03637803) with their candidate MRx0518 (single strain Enterococcus gallinarum) also in combination with Merck’s immune checkpoint inhibitor Keytruda® (pembrolizumab). Despite a small number of patients, results can be regarded as promising, as the disease control rate observed amply exceeded the thresholds established in the initial trial design (see press release here). The company announced it has initiated the second part of this trial (see press release here) and more recently reported topline results from their Phase 2 trial with live biotherapeutic Blautix® (Blautia hydrogenotrophica, NCT03721107, see press release here) as a stand-alone therapy for IBS.

These encouraging preliminary results from earlier-stage clinical trials are also of paramount importance for the entire industry, as they show early promise of microbiome drugs based on approaches very different from fecal transplant (namely: single strains, small molecules and molecules mined from the microbiome). Furthermore, their areas of application are very different from recurrent CDI, which shows potential therapeutic mechanisms of action of microbiome pharmaceuticals in oncology, autoimmune diseases and metabolic conditions.

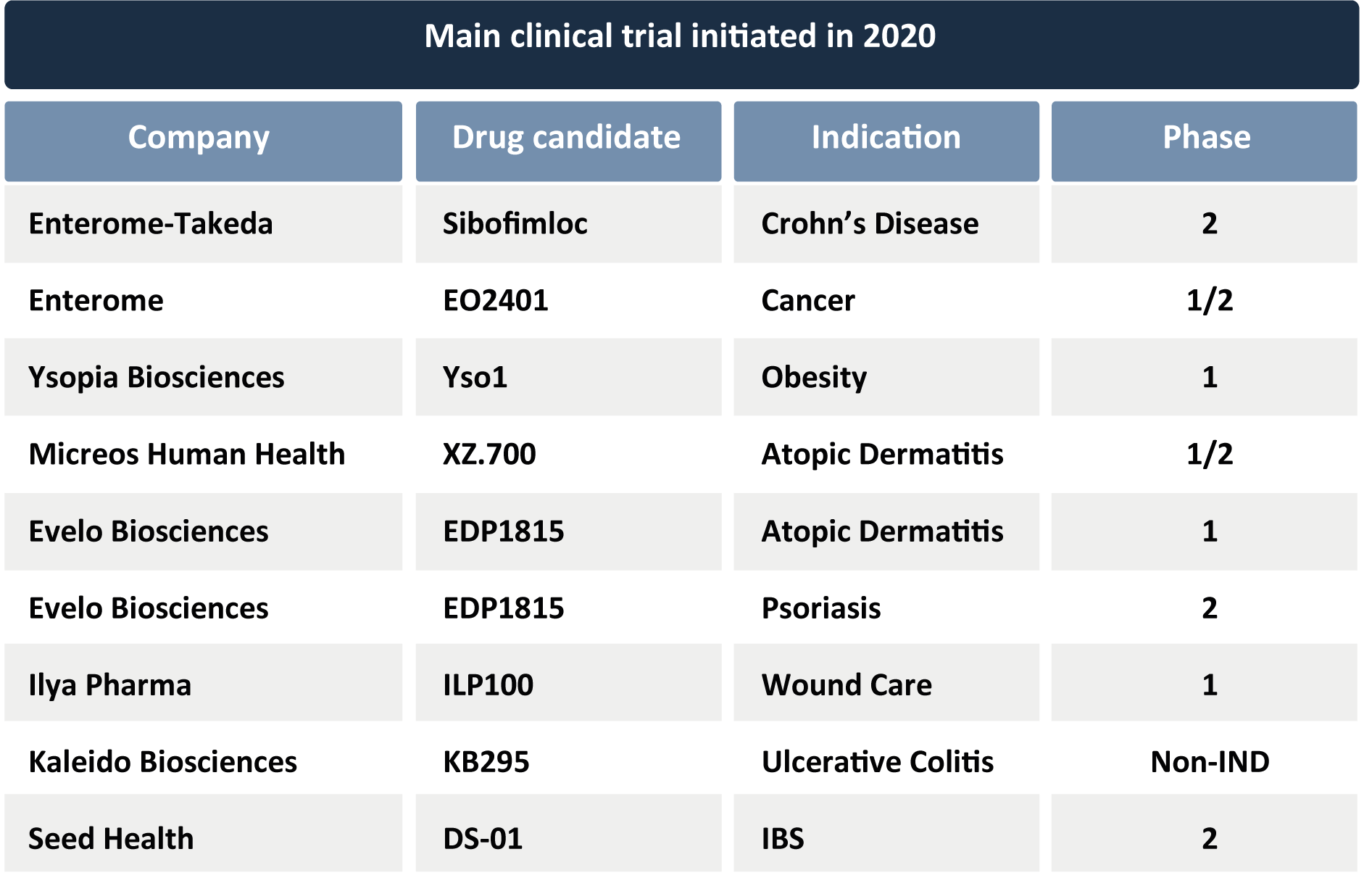

Perhaps most importantly from the business perspective, some of these key Phase 1 results from 2020 emphasize the potential role of some microbiome-based strategies as adjuvant therapies for existing medications. Showing that microbiome targets may improve the efficacy of established blockbusters such as immuno-oncology medications may be critical for attracting the attention of big pharma, as highlighted by the collaboration between Merck with both 4D Pharma and Evelo Biosciences around Keytruda® in different kinds of cancer. Keytruda® is Merck’s top-selling drug with annual revenues reaching almost €10Bn (see document here), and with projected sales growth to €20Bn per year by 2025; it is on track to becoming the world’s best-selling drug (see article here). Additionally, some companies announced the initiation of new clinical programs and trials in 2020. Enterome, with partner Takeda (TYO: 4502), announced that they have dosed the first patient of a Phase 2a trial (NCT03709628) with their Sibofimloc (also known as EB8018/TAK-018) in Crohn’s Disease. Sibofimloc is a small molecule antibiotic that binds a bacterial fimbrial adhesin (FimH), which Enterome has validated as a therapeutic target in inflammatory diseases (see press release here). Enterome also disclosed that they have initiated a Phase 1b/2a trial with their EO2401 OncoMimic as a stand-alone therapy against aggressive brain cancer (ROSALIE, NCT04116658) (see press release here). EO2401 is a combination of three microbiome-derived peptide antigens that closely resemble antigens expressed by tumor cells, and they are administered with the objective of training the immune system to destroy tumors.

Additionally, some companies announced the initiation of new clinical programs and trials in 2020. Enterome, with partner Takeda (TYO: 4502), announced that they have dosed the first patient of a Phase 2a trial (NCT03709628) with their Sibofimloc (also known as EB8018/TAK-018) in Crohn’s Disease. Sibofimloc is a small molecule antibiotic that binds a bacterial fimbrial adhesin (FimH), which Enterome has validated as a therapeutic target in inflammatory diseases (see press release here). Enterome also disclosed that they have initiated a Phase 1b/2a trial with their EO2401 OncoMimic as a stand-alone therapy against aggressive brain cancer (ROSALIE, NCT04116658) (see press release here). EO2401 is a combination of three microbiome-derived peptide antigens that closely resemble antigens expressed by tumor cells, and they are administered with the objective of training the immune system to destroy tumors.

Ysopia Bioscience (formerly known as LNC Therapeutics)received FDA’s Investigational New Drug (IND) approval in September for their Yso1 (formerly known asXla1), an orally-administered, single live strain of Christensenella minuta, in a Phase 1 clinical trial for the treatment of obesity (see press release here).

In dermatology, late September saw an announcement by Micreos Human Health that they enrolled the first patients in a Phase 1/2a trial with XZ.700 in patients with mild to moderate atopic dermatitis. This candidate is a bacteriophage-derived bacterial cell wall degrading enzyme (endolysin) that specifically targets skin-dwelling Staphylococcus aureus; this bacterium is considered to be causative and aggravating for atopic dermatitis. This will be the first time that endolysins are tested as a topical drug (see press release here). In October, Evelo Biosciences announced completion of enrollment for their Phase 1b trial investigating EDP1815 (single-strain Prevotella histicola) in individuals with atopic dermatitis as well as the initiation of a Phase 2 trial with that same candidate in psoriasis (see press releases here and here). Sweden’s Ilya Pharma also released completion of recruitment for a Phase 1 study with their lead candidate ILP100, a genetically engineered Lactobacillus that expresses the human chemokine CXCL12 which is applied topically, for wound care. This candidate is classed as an Advanced Therapy Medicinal Product by the European medicines Agency and as a low-risk gene therapy by the FDA (see article here).

Kaleido Biosciences (Nasdaq: KLDO) also informed the industry of the first dosing of patients enrolled in a clinical study to evaluate their Microbiome Metabolic Therapy (MMT™) candidate KB295 in patients with mild-to-moderate ulcerative colitis. KB295 is an orally-administered, synthetic glycan which acts by increasing microbiome-derived anti-inflammatory metabolites and decreasing pro-inflammatory microbial taxa in the intestine. Topline results are expected in mid-2021 (see press release here).

recently, Seed Health received IND authorization from the FDA to evaluate its defined consortium DS-01, containing 24 strains of 12 different microbial species, in a Phase 2 trial in patients with irritable bowel syndrome (see press release here).

Again, prospective positive results from these trials, which involve different therapeutic approaches, mechanisms of action and clinical indications, may trigger yet another wave of optimism in microbiome therapeutics over the next year.

A renewed interest in infectious diseases

A renewed interest in infectious diseases

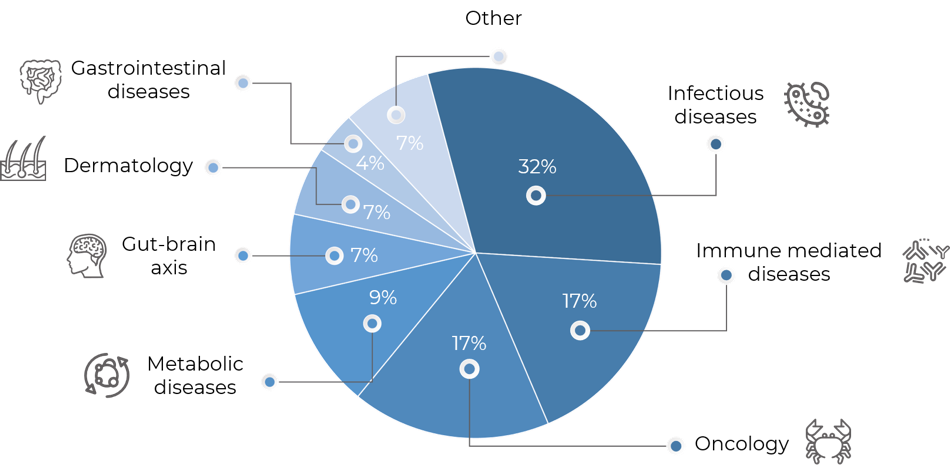

Treatment and prevention of infectious diseases has always been one of the leading applications of microbiome drugs, with a slight shift in proportion towards immune-mediated diseases and oncology in 2019. However, given the COVID-19 pandemic in 2020 and the increased public attention on infectious disease, microbiome companies have again steered their focus toward infectious diseases. Throughout 2020, a number of companies have actually discontinued immunity and oncology programs and/or begun infectious diseases initiatives, positioning anti-infective applications of microbiome drugs as the clear leading area, with 32% of all microbiome-focused drug development programs now devoted to infectious diseases, being CDI one of the main individual applications. Immune-mediated diseases (17%), oncology (17%) and metabolic diseases (9%) follow. The latter three, however, lost relative importance in the overall industry development pipeline compared to 2019. Besides infectious diseases, only dermatology applications grew compared to last year, with 7% of all development programs now devoted to this area (Figure 1).

Most of the growth in the infectious diseases segment comes from trials directly involving COVID-19 infection and symptoms. In fact, a total of 19 COVID-centric programs have been initiated by 15 different microbiome companies, all employing different approaches.

One of the most notable results is ExeGi Pharma’s July publication of the outcomes of a trial with their eight-strain bacterial consortium SivoBiome™ in combination with standard therapy in 70 hospitalized COVID-19 patients. The intervention led to fewer intensive care unit transfers (zero in the experimental group, two in the control group) and fewer deaths (zero in the experimental group, four in the control group). Furthermore, this bacteriotherapy improved other symptoms like diarrhea, fever, shortness of breath, abnormal physical weakness and myalgia (see press release here and published study here).

We have also seen drug repositioning of microbiome interventions initially designed to modulate the immune system. Evelo Biosciences is utilizing their EDP1815 , originally developed for inflammatory diseases such as psoriasis and atopic dermatitis as mentioned above, in two different a Phase 2/3 trials (EDP1815-205 and TACTIC-E), to evaluate its safety and efficacy in mitigating the hyperinflammation and cytokine storm associated with COVID-19 (see press release here). 4D Pharma, started a Phase 2 study with MRx-4DP0004 (a Bifidobacterium breve strain), as it has shown potential to simultaneously down-regulate a hyper-inflammatory response, including in the airways, while maintaining an appropriate anti-viral response (see press release here). Kaleido is investigating KB109 in outpatients with mild-to-moderate COVID-19, for its microbiome-modulating capabilities which may end up mitigating an inappropriate immune response in those with COVID-19.

Other microbiome drug developers are repurposing pharmaceutical candidates due to their antiviral capabilities. Cidara Therapeutics is investigating their antiviral conjugates (AVCs) against SARS-CoV-2 alongside other viruses. Immuron is evaluating whetherIMM-124E, a monoclonal antibody directed against lipopolysaccharide and initially developed for gastrointestinal infections, could inhibit SARS-CoV-2. Union Therapeutics has completed dosing in a Phase 1 study with UNI911 (inhaled niclosamide), after it has been identified as a potent inhibitor of SARS-CoV-2, with potency 40 times higher than the drug remdesivir (see press release here).

Innovation Pharmaceuticals (OTC: IPIX) is testing a modified defensin (brilacidin, PMX30063) after early results showing the capacity of this molecule to inhibit SARS-CoV-2 and to reduce the production of pro-inflammatory cytokines and chemokines. Brilacidin’s antimicrobial properties are also believed to support the fight against secondary bacterial infections (see description here). Also targeting concomitant bacterial infections is NovaBiotics, using Nylexa®, an antibiotic potentiator/resistance breaking agent being developed as an adjunct therapy to different antibiotics, to prevent secondary lung bacterial infections in COVID-19.

Leading Biosciences is looking at other manifestations of COVID-19 and investigating their serine-protease inhibitor LB1148 for coronavirus-associated acute respiratory distress syndrome and multiorgan dysfunction syndrome. LB1148 was originally designed to reverse complications of organ dysfunction associated with sepsis, shock and the post-surgical setting (see article here).

Other companies have repurposed their vaccine discovery platforms to try to find one against COVID-19. Adaptive Phage Therapeutics, a company focused on the development of bacteriophages to treat antibiotic resistant bacteria, has initiated a COVID-19 program based on phages engineered to display coronavirus antigens on their surface. Vaximm is employing their platform to generate different structural variants of the viral spike protein for immune generation purposes. Synlogic is applying their Synthetic Biotic platform for the development of a vaccine for the prevention of SARS-CoV-2. Prokarium is using their Vaxonella® platform for oral recombinant COVID-19 vaccine delivery.

Exploring yet another mechanism, Sporegen Ltd.and Destiny Pharmaplc.(AIM: DEST) aim at utilizing Sporegen’s non-vaccine, spore-based approach to stimulate the innate immune system via intranasal delivery to prevent SARS-CoV-2 infection (see press release here).

Independently from these COVID-19-focused initiatives, the global pandemic caused by SARS-CoV-2 will likely have a medium- to long-term impact on the whole biotechnology industry, including on microbiome drug development strategy, regulation and funding (see article here).

Fundraising momentum for established companies

All of the above factors have led to a significant increase in the investment captured by the microbiome drug industry. So far in 2020, almost €1Bn in dilutive funding has been committed to microbiome drug developers, almost a 100% increase compared to 2019, raising the total investment figure in these startups to over €5Bn.

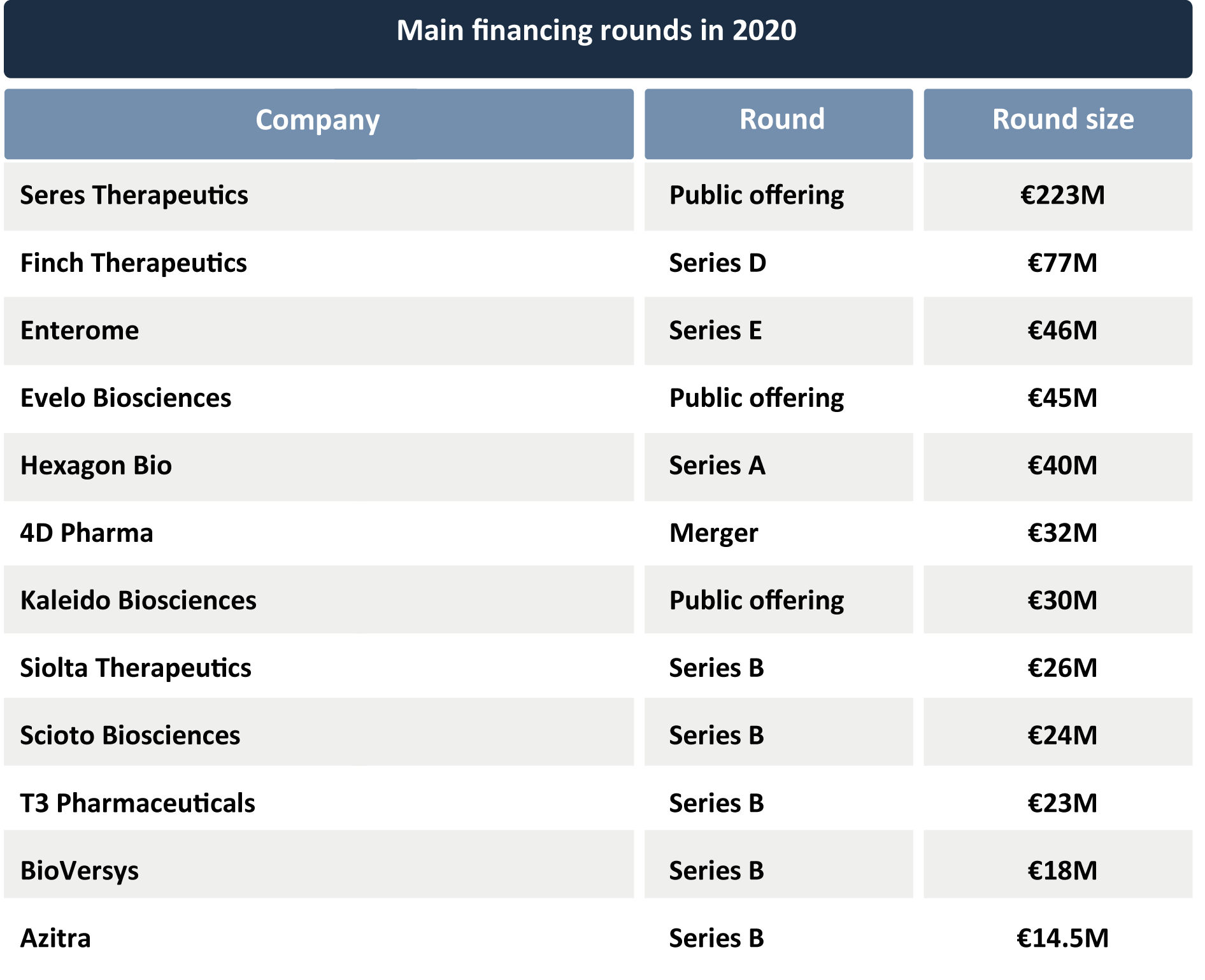

In 2020 we have seen some of the largest financing rounds in the history of the industry, including Finch Therapeutics’ €77M Series D round in September (see press release here), Enterome’s €46M Series E in June (see press release here), Hexagon Bio’s €40M Series A in September (see article here), Federation Bio’s €43M Series A round (see article here), Scioto Biosciences’ €24M Series B round led by another microbiome company, Genome & Co., in August (see press release here), T3 Pharmaceuticals’ €23M Series B in July (see press release here), Siolta Therapeutics’ €26M Series B in September (see press release here), BioVersys’ €18M Series B also in September (see press release here) and Azitra’s €14.5M Series B in October.

It is worth noting that the financing rounds completed throughout 2020 are later-stage funding compared to 2019. Whereas in 2019 over half of the funds devoted to microbiome companies were in Series A-C, in 2020 almost half of them were in Series B-E. Along with this came a significant increase in the average size of each round, as the almost doubling in total dilutive funds raised has occurred in a very similar number of rounds in YTD 2020 compared to 2019. This is one more sign of the maturation of the industry.

Investment growth has also been driven by major public offerings from Seres Therapeutics’ post-clinical-trial results placements of €223M in August (see press release here), as well as Evelo’s €45M offering and Kaleido Biosciences’ placement of €30M, both in June (see press release here)

Also this year, the company Forte Biosciences (Nasdaq: FBRX), a clinical-stage company focused on the development of a defined consortium of live bacteria to tackle atopic dermatitis, went public after a merger with Tocagen (see press release here). In October, 4D Pharma announced its merger with Longevity Acquisition Corp. (NASDAQ: LOAC) (see press release here). This deal is valued at €32M for 4D Pharma and will involve a dual listing for the company. It is likely that the favorable global environment for biotechnology companies, along with increased confidence and renewed enthusiasm in the microbiome field as a source of solutions generates further IPOs in the future, some of them potentially major.

Non-dilutive funding has also dramatically increased compared to 2019, as grants awarded to microbiome companies have more than tripled in 2020—especially, but not limited to, those developing candidates against infectious diseases. For this application, CARB-X and especially the Biomedical Advanced Research and Development Authority (BARDA) have been amongst the main supporters. In late September, Vedanta announced they had been awarded up to €65M to advance clinical development of VE303 for prevention of recurrent CDI (see press release here), on the same day that Locus Biosciences released that they had signed a co-development contract of up to €66M with BARDA on LBP-EC01, a CRISPR Cas3-enhanced bacteriophage (crPhage™) for Escherichia coli in urinary tract infections (see press release here).

Partnerships highlight the potential of the microbiome in drug development

Some had previously identified the lack of apparent interest by big pharma companies in microbiome-based drugs as strike against the industry. However, this year’s momentum around microbiome drug development has also taken the form of new partnerships between microbiome startups and established pharmaceutical players, especially around IBD biomarker and drug discovery.

The first of these deals was announced in April, between Second Genome and Gilead (Nasdaq: GILD) under which Second Genome’s Microbiome Analytics Platform™ will be employed to identify biomarkers associated with clinical response to Gilead’s investigational medicines in IBD. Under the terms of the agreement, Second Genome will receive from Gilead €32M in an upfront payment, and up to €256 million in success-based milestones (see press release here). This deal is particularly emblematic as it reinforces the trend of increasing collaboration between big pharma and microbiome startups to identify adjuvant therapies and companion diagnostics for non-microbiome-based drugs. It also highlights Gilead’s relatively recent expansion into immune diseases and oncology, which has materialized this year with other strategic collaborations outside the microbiome—Tango Therapeutics (August 2020) and Jounce Therapeutics (September 2020—as well as their acquisition of Forty-Seven, Inc. (€4Bn, March 2020) and Immunomedics (€18Bn, September 2020).

In June, Takeda and Debiopharm disclosed their licensing deal to develop novel microbiome therapeutics for IBD and other gastrointestinal disorders by employing Debiopharm’s discovery platform for narrow-spectrum microbiome modulation agents (see press release here). This deal also shows Takeda’s interest in microbiome technologies (between 2017 and 2020 it has signed deals with NuBiyota, Finch Therapeutics and Enterome) and also its position as a leading company in gastroenterology after its €53Bn acquisition of Shire Pharmaceuticals in 2019.

More recently, BiomX (NYSE: PHGE) entered a collaboration with Boehringer Ingelheim to utilize BiomX’s microbiome-based biomarker discovery platform to identify biomarkers associated with patient phenotypes in IBD (see press release here).

IBD has also been an area in which we have seen relevant collaboration terminations. For example, Janssen returned all rights on VE202 to its former partner Vedanta (see article here) and Synlogic regained rights on its IBD Synthetic Biotic medicines from its former partner AbbVie (NYSE: ABBV) (see press release here).

However, microbiome-pharma collaborations have not been restricted to IBD. For instance, in January Bayer AG and Azitra entered a joint development agreement which will leverage Azitra’s proprietary panel of Staphylococcus epidermidis strains to identify potential candidates for the treatment of skin conditions or diseases (see press release here), which further manifested in Bayer’s leading role in Azitra’s recent financing round. In April, Holobiome and Johnson & Johnson (NYSE: JNJ) announced their collaboration to develop bacterial consortia to treat digestive disorders. This is in fact the second agreement of this kind between these two companies, as they partnered up for the development of microbiome therapeutic for sleep disorders in 2018 (see press release here). In July, Nemesis Bioscience announced that it had reached an agreement Shionogi & Co (TYO: 4507) to utilize Nemesis’ Transmid Technology©, which inactivates antibiotic resistance genes in bacteria, for the treatment and/or prevention of respiratory infections caused by Pseudomonas aeruginosa (see press release here).

On the M&A side, 2020 did not see any major transactions involving microbiome companies as acquirees. However, Lodo Therapeutics, which mines environmental microbiome samples for novel therapeutic molecules, has been busy shopping around, as it acquired the artificial intelligence/machine learning company Conifer Point Pharmaceuticals, LLC in August (see press release here) and the cancer drug developer Hibiskus BioPharma in September (see press release here).

Emerging microbiome players

This year saw an apparent plateau in the number of new microbiome companies founded. YTD we have seen 5 new companies active in microbiome drug development, whereas 8 new players were founded in the full year 2019. The reason for this slowed growth in new companies may be partly related to logistical difficulties stemming from the COVID-19 pandemic, or from the fact that later-stage, established players are capturing more attention from investors (as observed in the financing metrics described above). Likely in 2021-2022 we will see a new uptick in company foundarions. It should be kept in mind that between 2012 and 2019, almost 160 microbiome drug developers were established, and only now are we seeing stronger clinical validation of the technologies developed by these companies.

Newcomers to the industry in 2020 are as follows:

Envivo (San Carlos, CA, USA) have developed CapScan®, a device that collects microbiome samples from all regions of the human gastrointestinal tract. Website: https://envivo.bio

Metagen Therapeutics (Yamagata, Japan) develop microbiome-based drugs using the Metabologenomics® platform, leveraging metagenomics and metabolomics data streams. Website: www.metagentx.com

MRM Health NV (Ghent, Belgium) is devoted to the development of therapeutics in IBD (lead program), as well as spondylarthritis and neurological disorders. They also have a program in metabolic diseases in collaboration with DuPont (NTSE: DD). Website: www.mrmhealth.com

Pulmobiotics S.L. (Barcelona, Spain) develop live biotherapeutics with a platform based on attenuated lung bacteria able to expose antigens or deliver therapeutic agents in the lung to treat respiratory diseases. Website: www.pulmobio.com

Teraomics S.L. (Alicante, Spain) is developing multi-omics diagnostics to detect and predict human conditions with unmet medical needs. Their platform is based on two novel concepts in modern microbiology that revisit Koch’s Postulates: pathobionts, i.e. non-infectious microbial signatures linked to human disease; and the recent speculation that diseases otherwise known as noncommunicable may be transmitted through microbes. Website: www.teraomics.com

A number of additional microbiome companies with the potential to develop pharmaceuticals or diagnostics have been identified. Due to limitations in publicly available information and/or for reasons of confidentiality, they cannot yet be mentioned. They will be highlighted in future reports and updates of the Microbiome Drug Database™once public information is available.

Luis Gosálbez

Sandwalk BioVentures is a specialty strategy, innovation, regulatory and management consulting firm focused on microbiome technologies servicing companies in the food and pharma sectors, as well as financial and strategic investors exploring to enter this field. The company has created the Microbiome Drug Database™, an online repository containing the most extensive and thorough analysis of biotechnology companies developing pharmaceuticals from or through the microbiome.