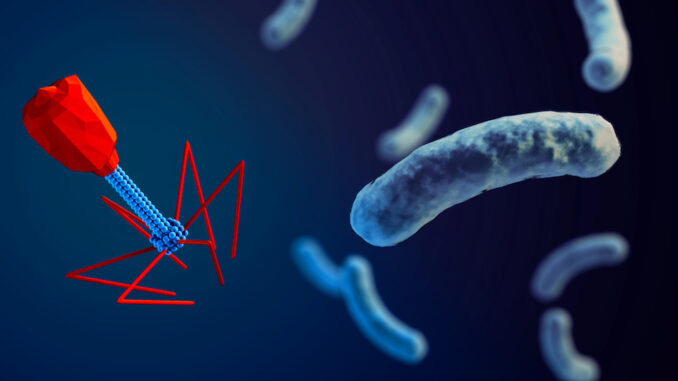

Armata Pharmaceuticals, Inc. (NYSE American: ARMP) (“Armata” or the “Company”), a biotechnology company focused on pathogen-specific bacteriophage therapeutics for antibiotic-resistant and difficult-to-treat bacterial infections, announced that it has entered into a securities purchase agreement to sell Armata common stock and warrants to Innoviva Strategic Opportunities LLC, a wholly-owned subsidiary of Innoviva, Inc. (Nasdaq: INVA) (collectively, “Innoviva”), Armata’s largest shareholder. The gross proceeds to the Company from the transaction are expected to be $45 million, before deducting estimated offering expenses payable by the Company.

Armata intends to use the net proceeds from this transaction to advance its clinical pipeline and strengthen its bacteriophage platform. The clinical pipeline is led by AP-PA02, currently under evaluation in the ‘SWARM-P.a.‘ trial as a novel therapeutic to treat chronic Pseudomonas aeruginosa infections in people with cystic fibrosis. A second study, ‘diSArm’, is evaluating AP-SA02 in patients with complicated Staphylococcus aureus bacteremia. The bacteriophage platform efforts include engineering phage for improved attributes and the planned build-out of a phage-specific GMP manufacturing facility.

“We are grateful to Innoviva for the strong vote of confidence in our Company and our technology that this investment represents,”

said Brian Varnum, Chief Executive Officer of Armata.

“Innoviva’s long term support has powered the clinical development of AP-PA02 and AP-SA02. This financing also enables us to commit to new clinical indications for these lead product candidates, including non-cystic fibrosis bronchiectasis and prosthetic joint infections,”

Dr. Varnum concluded.

Pursuant and subject to the terms and conditions of the securities purchase agreement and related agreements, Innoviva will purchase 9.0 million newly issued shares of Armata’s common stock, at a price of $5.00 per share, and warrants to purchase up to 4.5 million additional shares of Armata’s common stock, with an exercise price of $5.00 per share. The stock purchases are expected to occur in two tranches. Upon execution, Innoviva purchased approximately 3.6 million shares of common stock and warrants to purchase approximately 1.8 million shares of common stock for an aggregate purchase price of approximately $18.1 million. At the closing of the second tranche, upon Armata stockholders voting in favor of the transaction, Innoviva will purchase approximately 5.4 million shares of common stock and warrants to purchase approximately 2.7 million shares of common stock for an aggregate purchase price of $26.9 million.

Subject to the satisfaction of certain closing conditions, including the approval of Armata’s stockholders, the second closing contemplated by the securities purchase agreement is expected to occur near the end of the first quarter of 2022. The shareholders of Armata will receive a proxy statement seeking approval of the second closing in the coming weeks.

Armata received legal advice in the transaction from Thompson Hine LLP, and Ladenburg Thalmann & Co. Inc. provided a fairness opinion.

Willkie Farr & Gallagher LLP provided legal advice to Innoviva.

This release does not constitute an offer to sell or the solicitation of an offer to buy any security. The shares offered have not been registered under the Securities Act of 1933, as amended, or applicable state securities laws and may not be offered or sold in the United States or any state thereof absent registration under the securities act and applicable state securities laws or an applicable exemption from registration requirements.

About Armata Pharmaceuticals, Inc.

Armata is a clinical-stage biotechnology company focused on the development of precisely targeted bacteriophage therapeutics for the treatment of antibiotic-resistant and difficult-to-treat bacterial infections using its proprietary bacteriophage-based technology. Armata is developing and advancing a broad pipeline of natural and synthetic phage candidates, including clinical candidates for Pseudomonas aeruginosa, Staphylococcus aureus, and other pathogens. In addition, in collaboration with Merck, known as MSD outside of the United States and Canada, Armata is developing proprietary synthetic phage candidates to target an undisclosed infectious disease agent. Armata is committed to advancing phage with drug development expertise that spans bench to clinic including in-house phage specific GMP manufacturing.