Luis Gosálbez & Andrea Almagro

Introduction

Twenty twenty three marked a difficult year for the entire biopharmaceutical sector, with reduced funding across the field. Despite this difficulty, microbiome drug development companies became more creative and collaborative than ever, with partnership and M&A events reaching historical highs. Anticipated regulatory approvals were passed, positive clinical read-outs were announced, and exciting new research was published. In this annual review, the field’s key events will be explored, and discussed, covering regulatory & clinical developments, partnerships & M&A, published science, and financials.

On the PR side, microbiome science received significant media attention in 2023 as public awareness of the field continued to grow. This was exemplified by a number of articles on the subject in several influential media outlets including The Economist, Wired, and Quanta. Seres Therapeutics was even listed in Time magazine’s 100 most influential companies of 2023.

Regulatory & Clinical Development

In 2023 there were significant regulatory developments in the microbiome field. Notably, Seres’ VOWST® received FDA approval in April, triggering Nestlé Health Science’s $125M milestone payment. In Europe, Muvagyn®, a vaginal microbial drug, formerly classed as medical device, was authorized in Spain in May. The FDA lifted the 18-month clinical hold on Maat Pharma’s phase 3 program, MaaT013, in April. The European Parliament adopted the text of the upcoming Substances of Human Origin (SoHO) Regulation, and a new phage therapy chapter for the European Pharmacopoeia is in the making. The upcoming SoHO regulation will likely provide much-needed clarity as well as introduce new challenges for EU microbiome drug development.

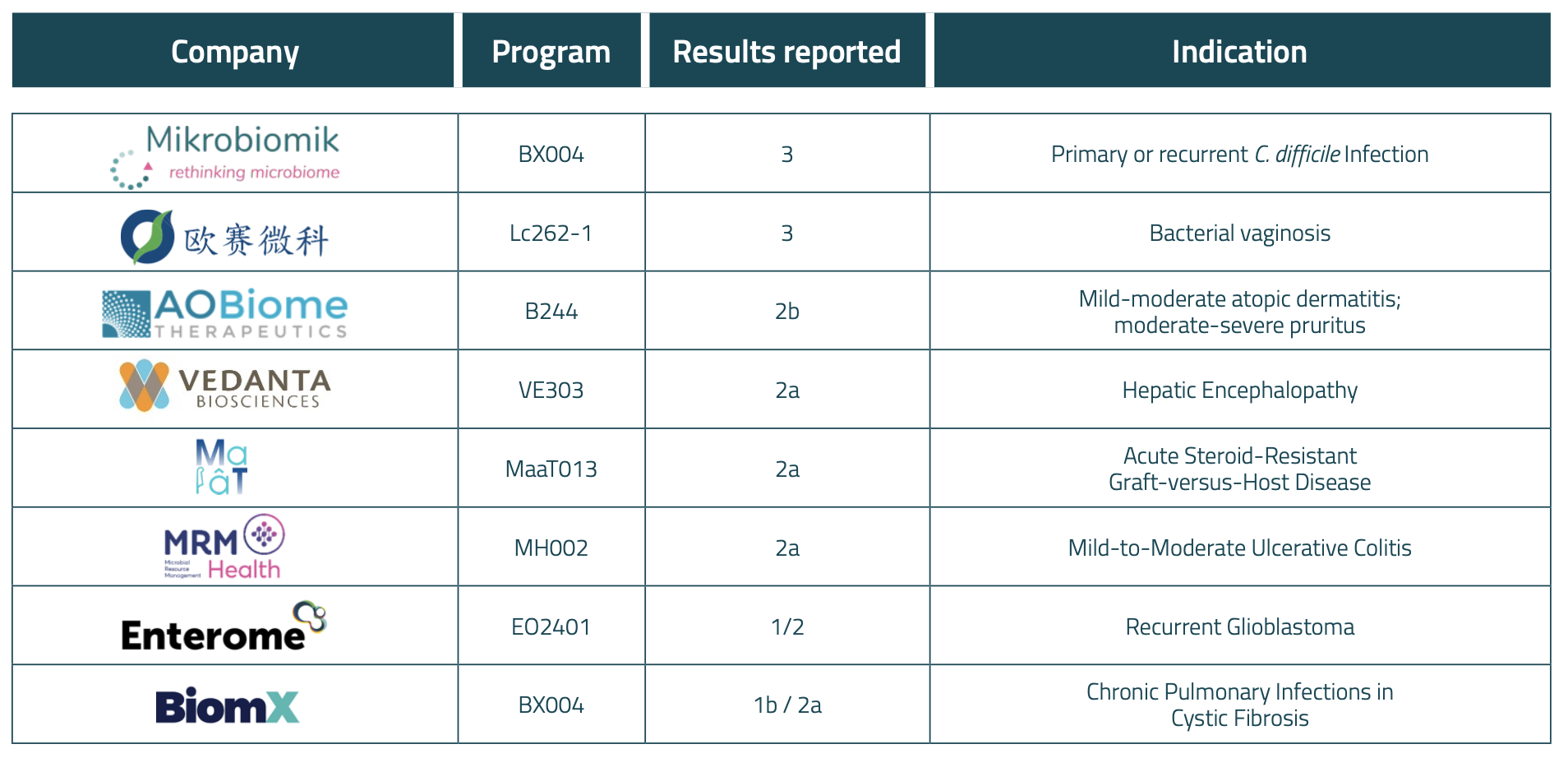

Positive progress was reported for several drugs in clinical development. With positive Phase 2 results reported by Vedanta Biosciences, Enterome, Maat Pharma, MRM Health, AOBiome and BiomX across a broad range of indications ranging from oncology to dermatology, to ulcerative colitis. We also recorded 9 programs successfully completing Phase 1.

Arguably the most exciting results came from the two companies who reported positive Phase 3 clinicals. In Europe, Mikrobiomik announced their Phase 3 MBK-01 program, an oral, donor-derived capsule for the treatment of primary or recurrent C. difficile infection, was subject to an early closure after an interim analysis revealed significant results before recruitment was completed. Publication of its report is expected in January 2024 and the company is already working with the European Medicines Agency for market authorization. In China, OSAI Biopharma reported positive Phase 3 data on their LBP dubbed Lc262-1, targeting Bacterial Vaginosis, and announced their intentions to submit a BLA application to China NMPA’s Center of Drug Evaluation in the near future.

Approval of LBPs outside the US and Australia is one of the milestones that the sector needs, and such an event would re-boost the entire sector globally.

Table 1. Main clinical later-stage results announced in 2023

Partnerships & M&A

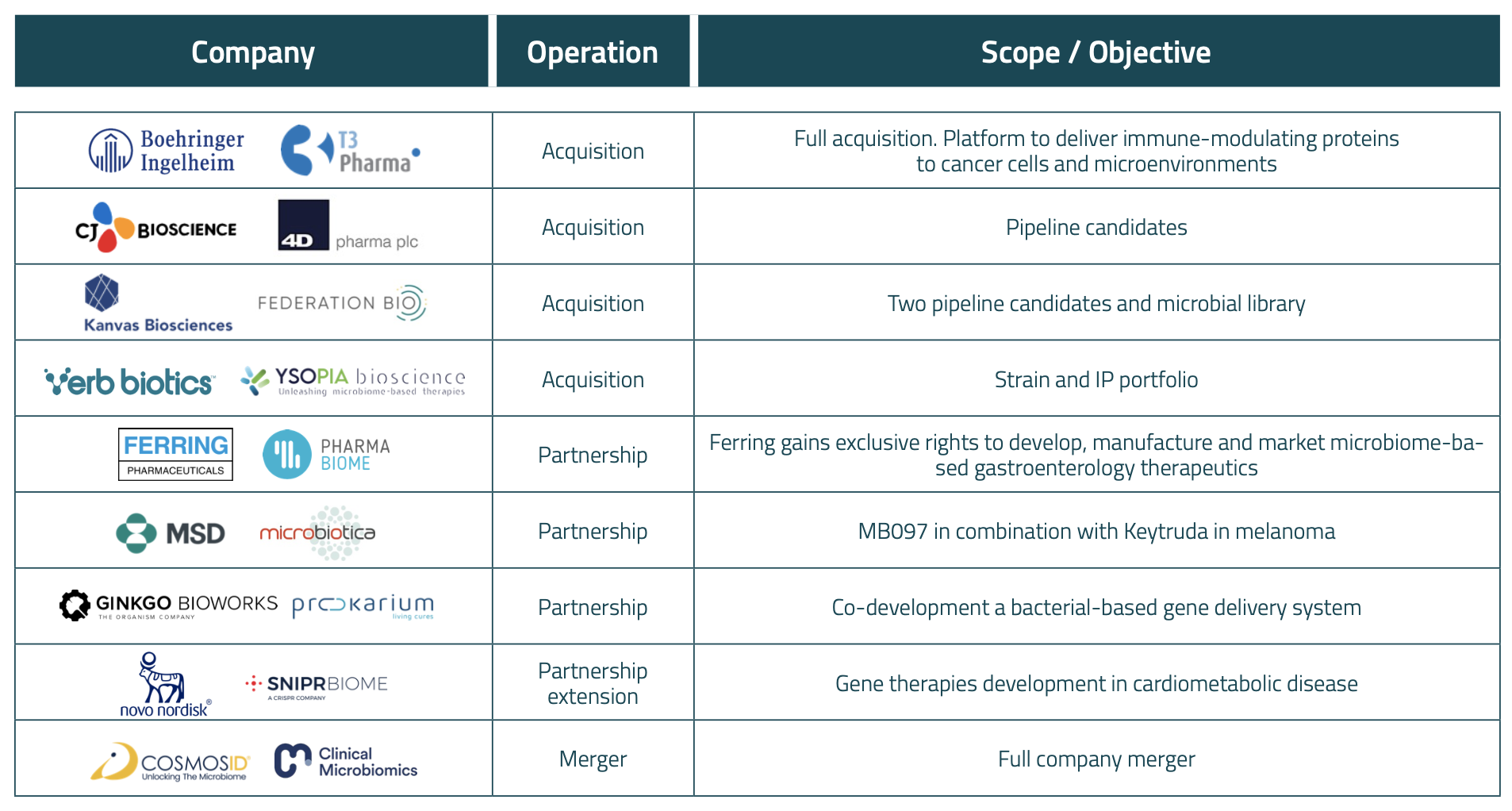

Microbiome drug development companies were very active in establishing partnerships in 2023. To name a few, in January, Prokarium and Ginkgo Bioworks disclosed they will be developing a bacterial-based gene delivery system together; in April, Microbiotica announced its partnership with MSD to evaluate its MB097 candidate in combination with Keytruda® in melanoma; in August, SNIPR BIOME extended their collaboration they initiated with Novo Nordisk in 2021 to develop novel gene therapies; and in December Pharmabiome and Ferring announced their collaboration to develop new drugs in gastroenterology.

A key trend of 2023, as we anticipated last year, was the dramatic increase in mergers and acquisitions, where we have seen a 3-fold increase in the number of deals compared to the historical annual average. The most prominent of which was Boehringer Ingelheim’s buyout of T3 Pharmaceuticals for up to $500M – making it potentially the largest acquisition in the space to date. Other major M&A events included CJ Bioscience’s integration of most of 4D Pharma’s pipeline, similar to Kanvas Biosciences’ acquisition of two of Federation Bio’s pipeline candidates, and Verb Biotics’ acquisition of YSOPIA Bioscience’s strains. Additionally, Biocodex fully acquired Targedys in June; two of the main service providers in the industry, CosmosID and Clinical Microbiomics, announced their merger in October; and Novozymes and Christian Hansen received authorization in Europe for their merger to become Novonesis in December.

Table 2. Main microbiome drug development partnerships and M&A operation announced in 2023.

Science

Lots of interesting microbiome science was published in 2023. Including new insights into the gut-brain axis, aging through the study of the microbiome of centenarians1, and on the relationship between microbiota and cancer and its therapy.

We also gained deeper insight into the biology of microbes, particularly of viruses and phages, as well as mechanisms that may have tremendous implications in the longer term. Some examples include:

- The first-ever observation of a virus attaching to a bacteriophage2.

- The description of thousands of previously-unknown viruses “hidden” within the bacterial DNA3, as well as in human organs4.

- The discovery that bacteria and human cells have the same core machinery for fighting viruses . This shared defence mechanism is based in the ubiquitin transferases cluster, an ancient molecular machinery5.

- The uncovering of a bacterial injection system which worked in human and animal cells, with potential use in gene therapy6.

- Mechanistic insights of the epibiotic lifestyle of microbial dark matter7.

- Perhaps most relevantly for the industry, reports that the stool microbiome is not representative of the gut microbiome8–10, and on the importance of the microbiota of the small intestine11.

- Of course, the everlasting discussions over the existence of normal blood12 and fetal13 microbiomes continue, although a significant post-natal transmission of mobile genetic elements from the microbiome of the mother to the offspring’s microbiome was described14, adding to the largest-ever study on vertical and horizontal transmission of microbiomes15, also published this year.

We also saw intriguing reports of FMT-mediated transmission of symptoms. Including of anorexia16 and Alzheimer’s17 symptoms from humans to a mice model, of autism symptoms from child stool donors to honeybees18, and even of menopause manifestations between humans in a home-made procedure19.

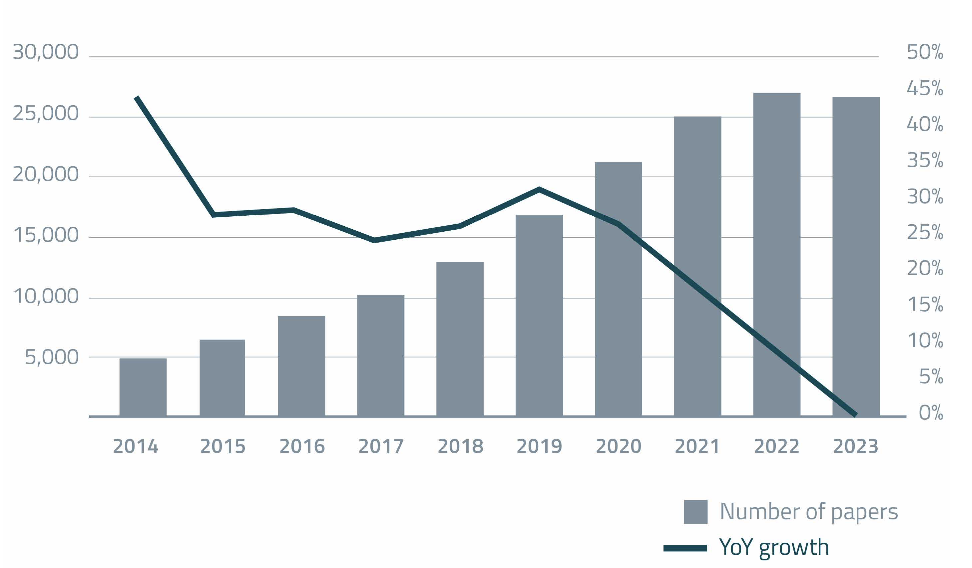

For the first time in history, the scientific output of microbiome science shows signs of exhaustion – the number of papers published on the topic remained stagnant (Figure 1) compared with the peak year so far, 2022 (at a “healthy” average of over 70 papers per day – more on this later).

Figure 1. PubMed results by keywords “microbiome” OR “microbiota” (blue bars) and annual growth rate of number of publications with those same keywords over the last decade.

Financials

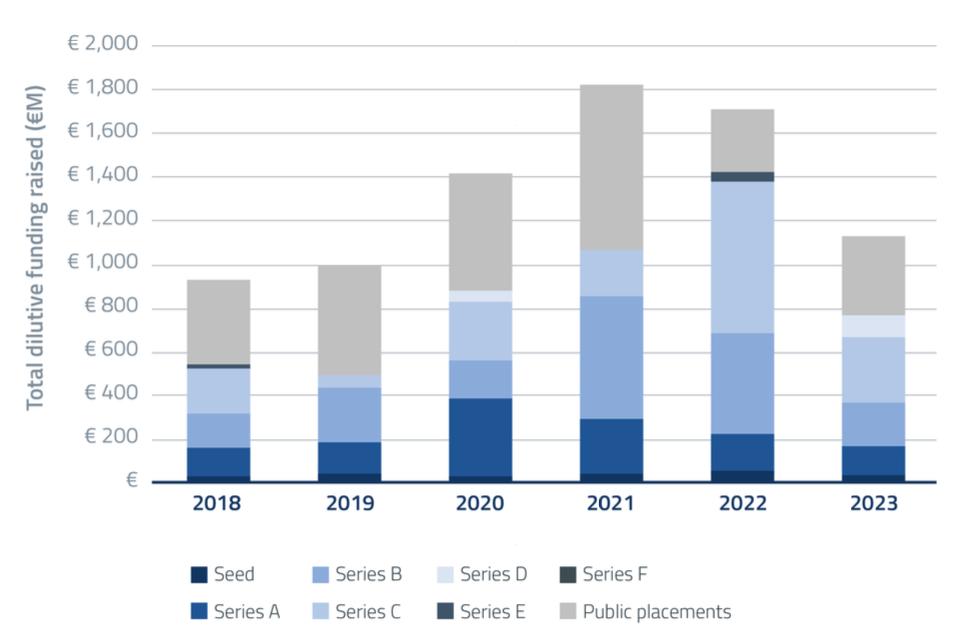

Just like in the broader biotech/ deep tech sector, financing in the microbiome field was down compared to 2022. Private rounds decreased both in number (by about 20%) and in size (by around 40%). Public placements rebounded to provide a significant share of cash to the industry (about 1/3 of all funds were raised this way), growing in size by around 30% from their all-time low in 2022. The positive year for the stock markets did slightly make up for the more cautious positions in the private sphere.

Overall, the dilutive funding captured by the industry in 2023 decreased by 30% to just north of €1.1Bn (Figure 2), with over 70% of the money invested in US companies and Asian investment experiencing an unexpectedly low year.

Figure 2. Total dilutive funding in the microbiome drug development industry by year. Private rounds are represented in different shades of blue; Public offerings are represented in grey.

This fuel shortage led to multiple layoffs and company closures (about 5% of the companies active last year, including some industry founders, have ceased operations in 2023). Also, a significant share of companies pivoted their operations towards other types of drugs such as non-microbiome-based immunotherapy, to next-generation probiotics development, or to cosmetics – a very hot field this year, with L’Oreal’s acquisition of Lactobio, Shiseido’s investment in Phyla, and Givaudan’s premiering its microbiome-centred fragrance technology, all these following from Beiersdorf’s acquisition of S-Biomedic in 2022.

On a positive note, in 2023, pharmaceutical companies seemed to re-engage with microbiome drug development, with Boehringer Ingelheim Venture Fund participating in Obulytix’s €4M Seed round, Sanofi Ventures’ involvement in Eligo Biosciences’ €28M Series B and Angelini Ventures joining Freya Biosciences’ €35M Series A.

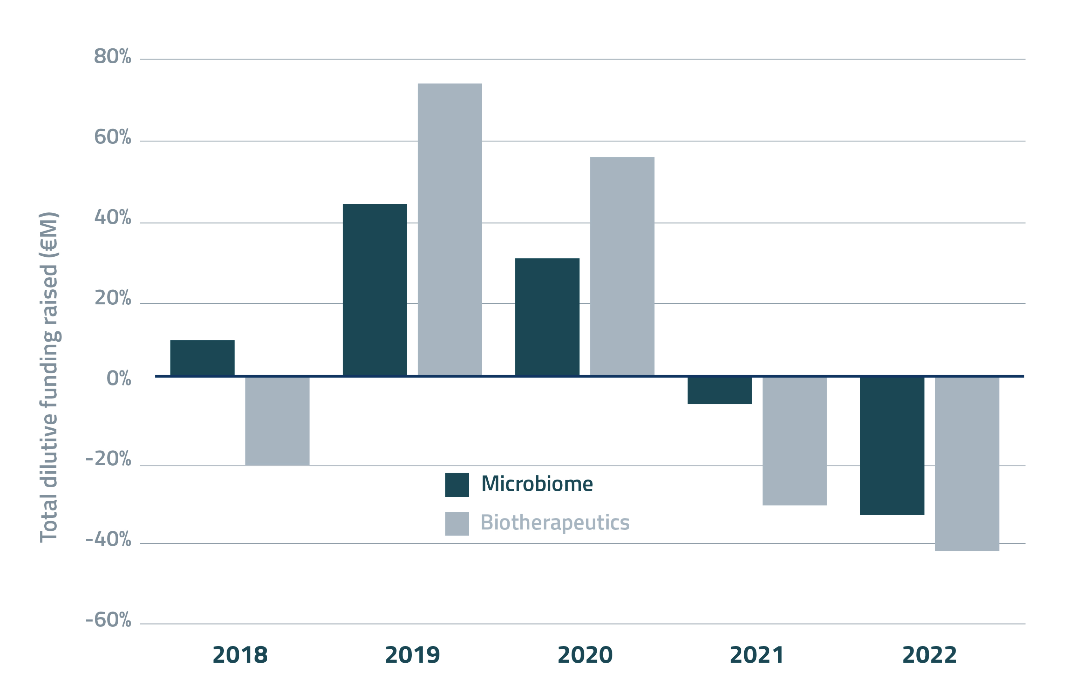

Whilst microbiome funding is down, financials should be interpreted in the broader context of the biotechnology industry, which has suffered an equally bad year – perhaps even worse. It is estimated that fundraising in the biopharmaceutical sector fell by up to 40% in 2023, with the lowest number of deals since 2017 (and down 20% from last year, Figure 3). Similarly for the broader biotechnology industry company shutdowns and workforce layoffs have also been rampant over the last 12 months. Thus, it appears it was a bad financial year for the biotechnology sector as a whole.

Figure 3. Year-on-year growth of private, dilutive funding in microbiome drug development (dark blue) vs. the overall biotherapeutic sector (grey).

What we may expect in 2024

It is difficult to predict what’s to come for the microbiome field, but experience indicates microbiome drug development is more dependent on the global economy and investor sentiment than its own merits – as most emerging technologies are. Inflation apparently under control in both Europe and in the US may lead to interest rate de-escalation and thus a more favourable fundraising environment. In fact, investment in microbiome drug development has been catching up over the last couple of months, as signs of economic improvement begin to show. Nevertheless, both very-early-stage, higher-risk companies, as well as some very-late, capital-intensive players, may continue to struggle to capture funds while a feeling of volatility persists. It is likely that 2024 will be another down-year for microbiome drug development, and the rate of new company formation will remain low.

The momentum of major regulatory approvals was already initiated in late 2022, and almost nothing radically new or unexpected happened in 2023 – which is not good. However, currently over 160 programs are in Phase 2 or Phase 3. Compelling results in just a handful of them may put microbiome drugs again on the main stage. Also, Europe is clearly lagging the US and Australia in terms of approvals. Since the industry is actively working with the European Medicines Agency and National Authorities in late-stage assets, any positive decision from Europe would be extremely reassuring for both investors and companies. There is also hope that good news could come from China in the coming months.

After some years in which most of the focus in microbiome research has been put on oncology, autoimmune and infectious diseases, in the broader pharmaceutical industry the main topic this year by far has been obesity, metabolic diseases and GLP-1. A new wave of microbiome-metabolism research may be on the way, hopefully with the financial help of some big pharma.

Last, and importantly, we may choose to read the stagnation in scientific production as a positive sign. Microbiome research has been frequently criticized as “correlational, not causational”, as difficult to replicate due to methodological challenges, and as being over-hyped. Fewer science publications may mean more thoughtful science, and more thoughtful science will yield a stronger industry.

About Sandwalk BioVentures

Sandwalk BioVentures is a specialty strategy, regulatory, innovation, and management consulting firm specialized in microbiome technologies, servicing companies in the food and pharma sectors, as well as financial and strategic investors active in this field.

The company has created the Microbiome Drug Database™, an online repository containing the most extensive and thorough analysis of biotechnology companies developing pharmaceuticals from or through the microbiome.

- For any inquiries via email: info@sandwalkbio.com

- Stay connected with us on LinkedIn for the latest updates and insights here.

- Explore more about our work and services at www.sandwalkbio.com

References

- Liu, X. et al. Mendelian randomization analyses reveal causal relationships between the human microbiome and longevity. Sci Rep 13, 5127 (2023).

- deCarvalho, T. et al. Simultaneous entry as an adaptation to virulence in a novel satellite-helper system infecting Streptomyces species. ISME J 17, 2381–2388 (2023).

- Bellas, C. et al. Large-scale invasion of unicellular eukaryotic genomes by integrating DNA viruses. Proceedings of the National Academy of Sciences 120, (2023).

- Pyöriä, L. et al. Unmasking the tissue-resident eukaryotic DNA virome in humans. Nucleic Acids Res 51, 3223–3239 (2023).

- Ledvina, H. E. et al. An E1–E2 fusion protein primes antiviral immune signalling in bacteria. Nature 616, 319–325 (2023).

- Kreitz, J. et al. Programmable protein delivery with a bacterial contractile injection system. Nature 616, 357–364 (2023).

- Wang, Y. et al. Genetic manipulation of Patescibacteria provides mechanistic insights into microbial dark matter and the epibiotic lifestyle. Cell 186, 4803-4817.e13 (2023).

- Levitan, O. et al. The gut microbiome–Does stool represent right? Heliyon 9, e13602 (2023).

- Shalon, D. et al. Profiling the human intestinal environment under physiological conditions. Nature 617, 581–591 (2023).

- Folz, J. et al. Human metabolome variation along the upper intestinal tract. Nat Metab 5, 777–788 (2023).

- Delbaere, K. et al. The small intestine: dining table of host–microbiota meetings. FEMS Microbiol Rev 47, (2023).

- Tan, C. C. S. et al. No evidence for a common blood microbiome based on a population study of 9,770 healthy humans. Nat Microbiol 8, 973–985 (2023).

- Kennedy, K. M. et al. Questioning the fetal microbiome illustrates pitfalls of low-biomass microbial studies. Nature 613, 639–649 (2023).

- Vatanen, T. et al. Mobile genetic elements from the maternal microbiome shape infant gut microbial assembly and metabolism. Cell 185, 4921–4936 (2022).

- Valles-Colomer, M. et al. The person-to-person transmission landscape of the gut and oral microbiomes. Nature 614, 125–135 (2023).

- Fan, Y. et al. The gut microbiota contributes to the pathogenesis of anorexia nervosa in humans and mice. Nat Microbiol 8, 787–802 (2023).

- Grabrucker, S. et al. Microbiota from Alzheimer’s patients induce deficits in cognition and hippocampal neurogenesis. Brain 146, 4916–4934 (2023).

- Li, Y. et al. The fecal microbiota from children with autism impact gut metabolism and learning and memory abilities of honeybees. Front Microbiol 14, (2023).

- Emily Joshu, H. R. for Dailymail. com. Man who performed ‘DIY’ fecal transplants from his mom after Crohn’s disease left him hospitalized experienced her menopause symptoms. https://www.dailymail.co.uk/health/article-12754413/mom-fecal-transplant-son-crohns-disease-hospitalized-menopause-symptoms.html (2023).