BiomX Inc. (NYSE American: PHGE) (“BiomX” or the “Company”), a clinical-stage microbiome company advancing novel natural and engineered phage therapies that target specific pathogenic bacteria, announced today it has entered into a definitive agreement with institutional investors, all of the Company’s directors and certain executive officers for the purchase and sale of an aggregate of 3,750,000 shares of the Company’s common stock and warrants to purchase an aggregate of 2,812,501 shares of the Company’s common stock in a registered direct offering, for expected gross proceeds of $15 million before deducting placement agent fees and offering expenses and assuming that none of the warrants are exercised.

The securities are being sold at an offering price of $4.00 per share of the Company’s common stock and an accompanying warrant to purchase 0.75 of a share of the Company’s common stock at an exercise price of $5.00 per share. The warrants will be exercisable six months after the date of issuance and will expire five years from the date such warrant first becomes exercisable. The purchase price to the Company’s directors and executive officers may be increased in order to comply with NYSE American stock exchange rules.

The closing of the offering is expected to occur on or about July 28, 2021, subject to the satisfaction of customary closing conditions, including, but not limited to, approval by NYSE American.

Cantor Fitzgerald & Co. and Chardan are acting as placement agents for the offering.

The Company intends to use the net proceeds of the offering to support clinical trials and for general corporate purposes, including working capital.

The offering is being made pursuant to an effective shelf registration statement on Form S-3 (File No. 333-251151) previously filed and declared effective by the Securities and Exchange Commission (the “SEC“) on December 11, 2020. A prospectus supplement describing the terms of the proposed offering will be filed with the SEC and will be available on the SEC’s website located at http://www.sec.gov. Electronic copies of the prospectus supplement may be obtained, when available, from Cantor Fitzgerald & Co., Attn: Capital Markets, 499 Park Avenue, 4th Floor, New York, New York 10022, by email at prospectus@cantor.com, or from Chardan Capital Markets, LLC, Attn: Capital Markets, 17 State Street, Suite 2100, New York, New York 10004, by email at prospectus@chardan.com.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About BiomX

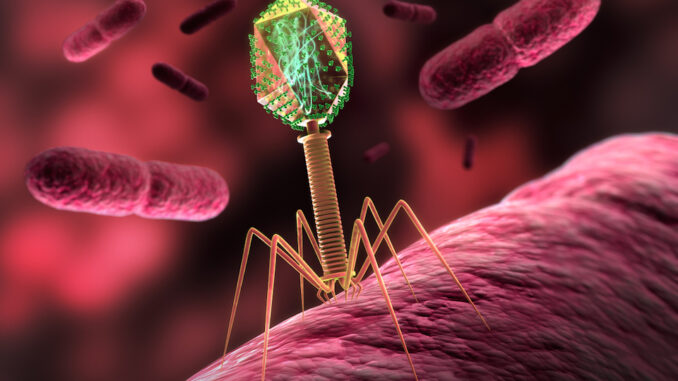

BiomX is a clinical-stage microbiome company developing both natural and engineered phage cocktails designed to target and destroy bacteria that affect the appearance of skin, as well as target bacteria in the treatment of chronic diseases, such as inflammatory bowel disease, primary sclerosing cholangitis, cystic fibrosis, atopic dermatitis and colorectal cancer. BiomX discovers and validates proprietary bacterial targets and customizes phage compositions against these targets.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. Forward-looking statements can be identified by words such as: “target,” “believe,” “expect,” “will,” “may,” “anticipate,” “estimate,” “would,” “positioned,” “future,” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. For example, BiomX is using forward-looking statements when it discusses the expected closing of the offering and its intended use of proceeds. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on BiomX management’s current beliefs, expectations and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of BiomX control, including market conditions and the satisfaction of customary closing conditions related to the offering. Actual results and outcomes may differ materially from those indicated in the forward-looking statements. Except as otherwise required by law, BiomX undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Therefore, investors should not rely on any of these forward-looking statements and should review the risks and uncertainties described under the caption “Risk Factors” in BiomX’s Annual Report on Form 10-K filed with the SEC on March 31, 2021 and additional disclosures BiomX makes in its other filings with the SEC, which are available on the SEC’s website at www.sec.gov. Forward-looking statements are made as of the date of this press release, and except as provided by law BiomX expressly disclaims any obligation or undertaking to update forward-looking statements.